Introduction

The world is looking for alternative sources of fuel, but still oil plays a very crucial role in the world economy. We cannot imagine a world without oil. It literally runs our daily life. Our homes, offices, schools, colleges, infrastructure, on the whole, transportation, industries, and legit everything is dependent upon oil. With this, the oil prices see the most amount of fluctuations. And hence these fluctuations directly affect the world economy. Investing in oil is hence a very risky idea, and one should know about all factors that affect its prices.

Factors Affecting Oil Prices

What Causes Oil Prices to Fluctuate? The Organization of Petroleum Exporting Countries directly controls these prices but makes them cause fluctuations in them? There are the following factors that cause fluctuations in oil prices.

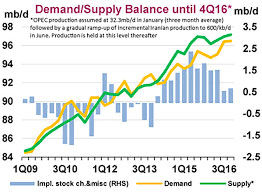

- The first and foremost factor is demand and supply, which affects any commodity and its price. Supply is “how much oil is being produced?” Demand is “how much oil is used in different activities and domains like transport, infrastructure, fuel, etc.?” When demand is less than the supply, we see a fall in prices.

On the contrary, demand more than supply would lead to increased prices of commodities, and oil is no exception. Supply is determined by the thirteen countries, forming the Organization of Petroleum Exporting Countries. Oil prices fall quickly and sharply as soon as the producers, i.e. these thirteen countries manage to produce more oil than the demand. Demand overall controls oil prices. Economic growth and demand are in direct relation; with an increase in economic growth, the overall demand for oil increases.

- Natural calamities or disasters also cause a huge variation in oil prices. Here supply and demand do not matter much. We have quite a lot of instances where calamities affected only one region, and prices fluctuated globally.

- Another important factor is unstable geopolitics. Politics has firm and strong control over the economy. Unrest in any of those thirteen countries forming the Organization of Petroleum Exporting Countries can lead to a worldwide rise in oil prices. The world has faced many events when any minor or major political instability has deprived the world of affordable oil.

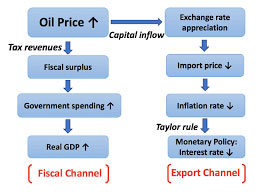

- The Interest rate can affect oil in any way. Different economists have proposed different theories in this regard, and almost all of them are correct. One of them suggests that there exists an inverse relationship between interest rate and oil prices. According to them, higher interest rates would decrease the number of vehicles on roads which can stimulate a decrease in demand. We have already seen that a low demand decreases oil prices. The opposite would happen in the alternative case. A greater demand calls for a greater supply and a sharp increase in prices. Another theory states that a higher interest rate increases the worth of a dollar and that increases the purchase of oil by the US. An Increase in the purchase would cause an increase in supply to consumers. This shows a direct relationship between both.

Effects of High Oil Prices on Economy

Higher oil prices lead to an increase in prices of all necessary and household goods. Transport becomes expensive. Infrastructure gets disturbed. Inflation, in turn, causes a decrease in economic growth. Rising oil prices increase the cost of production for several goods that are necessary for the production of corresponding products. It happens in a chain; an increase in oil prices increases the prices of transportation and infrastructure, which causes a massive rise in prices of general goods used on a daily basis. The whole marketplace sees a crippling situation.

High oil prices sometimes cause a decrease in the demand for a few goods due to their high prices. It again affects the overall economy of a country. Importing countries face the most challenges during this period. Also, the time for which it happens creates a pressure of profit on the producers, investors, and general holders of the marketplace. Industrial countries earn by exporting their goods but to make those goods, they need fuel, and if that fuel is out of their reach, their economy will cripple too. Hence, a worldwide fluctuation in oil prices can put the whole world at a standstill.

Conclusion

Oil is the primary means of earning for half of the world as almost every sphere of life is directly or indirectly affected by it. It may be due to any reason, but a stable oil price is necessary for the economic growth and prosperity of a country.