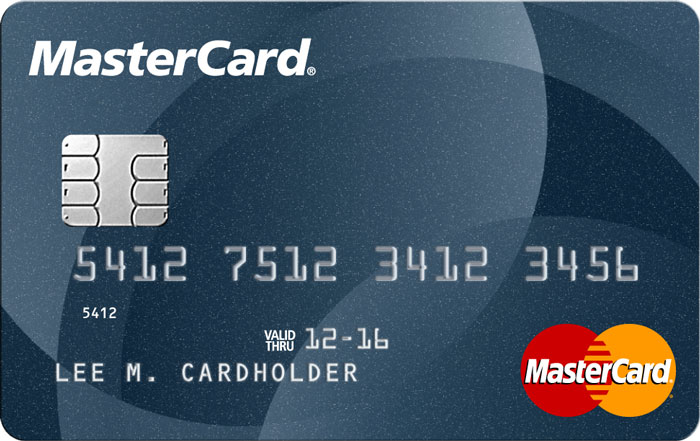

Chip cards are typical-sized plastic credit or debit cards with an embedded microchip and a conventional magnetic stripe. The chip encrypts data to ensure data security when you make transactions in-store terminals, terminals, or (ATMs). Chip cards are also referred to by the names of smart cards, chip-and-PIN cards, or chip-and-signature cards, as well as they are also known as the Europay, Mastercard, and Visa (EMV) cards.

Working

The plastic card has served as a popular payment method for a long time, providing customers with convenience and security regarding cash transactions—credit cards with revolving credit - like that we use today since the 1950s. Meanwhile, debit cards were in circulation from the late 1960s. The information about your account, like the cardholder's credit limit in addition to the balance remaining and transaction limits, were recorded in the magnetic stripe on the back of the card.

Chip cards became a worldwide standard for credit and debit transactions following the technology's introduction developed in the form of Europay, Mastercard, and Visa. It's why it's known as an EMV card. Chip cards contain a small microchip of gold or silver on one side of the credit or debit card. Similar to the magnetic stripe, the chip holds details regarding the account(s) associated with the card. The technology was initially used in Europe before it became a norm worldwide. The United States adopted the technology in October 2015.

To use this card user places the card inside a terminal with chip technology like an ATM or point-of-sale (POS) terminal. The terminal sends details of the cardholder to the card provider's website or the merchant's site. If the account balance is sufficient to support the transaction, it's accepted. If it is not, the terminal denies the transaction, and the transaction does not pass through. Certain terminals require cardholders to input the personal ID code (PIN) or sign for the payment to be completed.

Types of Chip Cards

In most instances, the cardholder is asked to insert their chip card at an ATM terminal to purchase in the United States. In some cases, including in other countries--cardholders may be required to complete additional steps to complete a purchase or cash out from an ATM with one of the cards listed below.

Chip-and-Signature Cards

A card with a chip and signature offers a slightly more secure option than the magnetic stripe. Instead of using the magnetic stripe, a user uses the chip to transfer information directly from their terminals to their bank. If the transaction gets accepted by the financial institution, the customer must provide the signature required for the payment to be completed.

Chip-and-PIN cards

They provide the highest protection for the consumer. They function the same way as an ordinary chip card; however, they require a PIN to complete the transaction. The customer must input their identification number to pay for a purchase or withdraw cash from an ATM using their debit or credit card. PINs are often used for ATM withdrawals made with credit and debit cards within the United States. Customers in Canada, as well as other countries, are required to enter PINs no matter the method or location they use for their cards, even whether it's a credit or debit card.

Do I Need a Chip Card?

You'll probably need an electronic chip card shortly if you intend to keep making card transactions domestically or internationally. If you have one of the older magnetic stripes credit cards that haven't expired yet, you'll still be able to utilize it. However, if a merchant decides not to accept old cards that don't have chip-card technology and you're not eligible, it's a no-go.

There is also the possibility of issues if you go to countries that depend on card-based payments and do not want to pay with cash. If your card isn't equipped with chips at present, the chances are that it will be when you change it. At present, U.S. card issuers only issue cards that have chips.

Alternatives to Chip Cards

Many cardholders complain that transactions made with chip cards are slow to process, especially when you must put your card in a reader and wait for its beep. Chip-card technology has advanced since its introduction in people in the United States. It's now not as slow as it used to process.

However, if you're in a hurry, you could save time using your mobile or another wearable device, like smartwatches, for contactless payment. Contactless payments are only possible when the merchant's payment device has Near Field Communication (NFC) technology. You may also be able to pay by hand and make use of cash if a merchant is willing to accept the payment.