What Is a Covered Call?

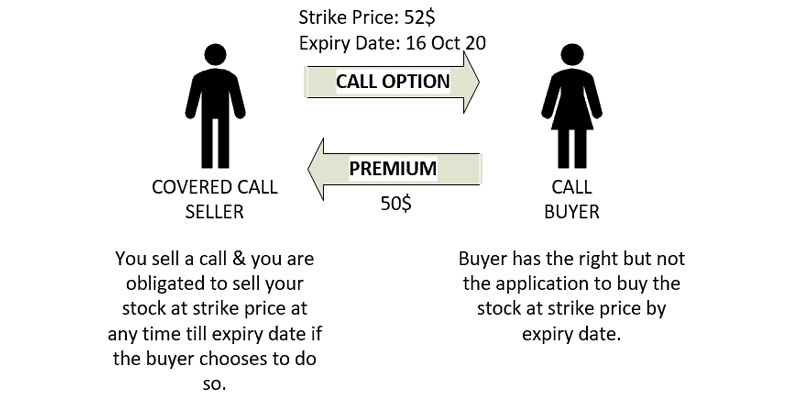

You might be thinking that what is covered call strategy? The term "covered call" is used to describe a financial transaction where the person selling call options has an equal amount of the security. To accomplish this, an investor interested in a significant asset puts in (sells) option calls for the asset to earn the income. The position of the investor within the assets is called the cover, which means that the seller can transfer shares if the purchaser who purchased the option decides to exercise the option.

Covered Call Example

Here's a basic illustration of a covered call strategy. You have bought 200 shares of XYZ firm for $200 per share. You are confident that the stock market won't face enormous volatility anytime soon. You also believe that the price of shares of XYZ firm will grow to $205 within the next three months. To lock in your earnings, you purchase one call option contract that has a price at the strike of $205 and expires in three months (remember that a call contract is comprised of 200 shares). The cost of the call option will be $5 for each share within the contract.

Covered Call Strategy

- Covered calls are a well-known option strategy to earn earnings in the form of premiums for options.

- When they make the covered call, investors can only anticipate a slight change or reduction in the value of the stock that is the basis for the duration of their option.

- To execute the covered call method, an individual who holds an asset with a significant position then sells the call option on the same asset.

- Covered call options are frequently used by investors who plan to hold the stock for a prolonged period. However, they do not anticipate any significant price rises soon.

- This strategy is perfect for those who believe that the price they invest in is not likely to change much in the next few months.

A Profitable Strategy

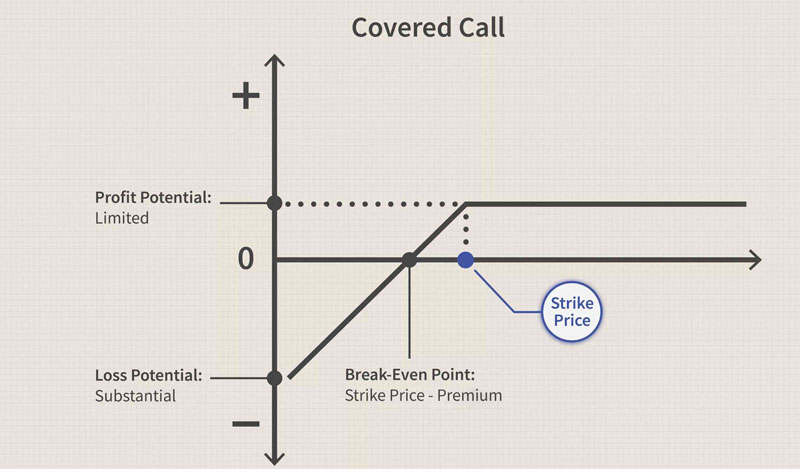

As with all trading strategies covered, calls could be or are not profitable. The best return from covered calls is when the stock price increases at the price that is the strike of the call sold and not any more than that. Investors benefit from a slight increase in the value of the stock and receive all the premium for the option when it expires in vain. Like all strategies covering call writing, it has benefits and drawbacks. If you choose the right stock, covered call writing can be an excellent option to cut your costs or earn income.

The Advantages of A Covered Call

Covered calls provide investors with three benefits.

- The money earned from the sale of covered calls can be retained as income.

- Many investors use covered calls to achieve this and sell covered calls regularly at times monthly and occasionally quarterly, intending to add some percent of cash income to their yearly profits.

- Covered calls that are sold can assist investors in determining an appropriate selling cost for the stock which is greater than that of the current price. If a buyer is prepared to sell shares at this price, the covered call can help achieve the desired price even if the price does not rise to that level.

- Another reason investors may use covered calls is to gain a little downside protection. The price you pay for covered calls is just a tiny fraction of the value of the stock, and the risk (if it is described as such) is small.

Are Covered Calls Risky?

Covered call options are generally considered to be risk-free. However, covered calls will limit any future gains if the price continues to climb and will not shield you from an eventual drop in price. It is important to note that, like covered options, writers who do not have an equivalent share of the stock underlying are called "naked call writers." These calls are an almost limitless loss risk when the security value is increased.

Conclusion

Covered calls are a well-known option strategy that generates revenue in premiums on options. A covered call can be the most critical call in every business. Hence, when a company is on the brink of destruction, the investor buys its shares and constructs the pillar to stand again at the same time in every business.