Credit Card Issuer

Credit card companies are financial institutions that issue applications, manage, and then approve them for credit account holders. As a cardholder is an organization you'll work with whenever you take actions like checking your credit balance on your credit card as well as paying your bill or declaring your card to be inactive. What Is a Credit Card Issuer? Credit card issuers are the type of lenders, usually an institution like a credit union or bank, which extends credit to customers in the form of credit cards. The issuers of credit cards accept the degree of stake when they accept credit card applicants and provide the limit of credit. Credit card issuers review each application and decide on the conditions for credit cards based on your credit score.

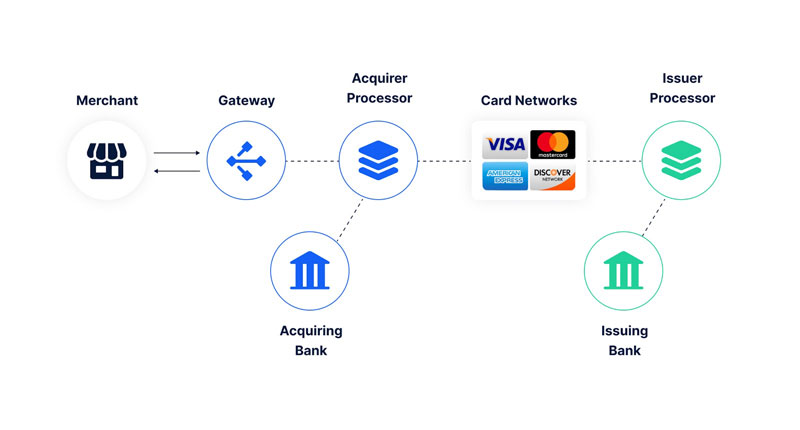

Certain cards may offer reward points or other incentives to convince customers to enroll in credit cards. Credit card issuers differ from transaction processing systems such as Visa or MasterCard. Networks process and authorize transactions, define the conditions of transactions, and facilitate payments between merchants and credit card givers, and cardholders. Credit card issuers must comply with government regulations when they issue credit cards. They also need to cooperate with payment processing companies that facilitate credit card transactions.

A lot of personal information is transmitted during the request process. Credit card companies must have the capacity to handle the volume of transactions and ensure that the data is safe from hackers. Name of the credit union or bank that issues a credit card typically appears on the card's front, together with the logo of the associated network like Visa and Mastercard. If the issuer's name isn't visible on the front of the card, it might show up on the reverse of your credit card in a tiny print. It's essential to know the credit card issuer. It is possible to reach them if:

How Credit Card Issuers Work

They are the financial establishments that offer credit cards to customers. When you use your credit card, it's the issuer you're borrowing funds from. The issuers of credit set limits, provide benefits to cardholders as well as charge fees and interest as well as others. While they don't handle your transactions with merchants, they're responsible for approving or denying the transactions.

Understanding the Payment Network

A different name you'll see in your credit cards is the payment processor's name, including Visa, Mastercard, American Express, or Discover. This organization acts as the middleman in charge of processing the payment for the business. They handle the relationship with the issuer of credit cards and the processor for merchants, which is the business that stores work that accepts credit card transactions.

The payment networks may also play an essential role in distributing benefits for cardholders on behalf of those who issue cards. The benefits are likely to be managed via the payments network. Although you may have to speak with a specific benefits administrator, there's no reason you should ever have to call an organization that's only acting as a network for payments like Visa as well as Mastercard.

How Credit Card Networks and Issuers Work Together

Issuers and card networks collaborate to handle transactions consumers conduct when they shop at merchants.

· Finding the Credit Card Issuer

The credit card issuer's number may be a reference to the phone of the company that issued it or the issuer's identification detail. Find out more about each.

· Credit Card Issuer Phone Number

To find the number for the credit card issuer, look up the number listed at the bottom of your card, or visit the issuer's website to locate the correct number. The issuer could offer different numbers for various forms of inquiries: customer service inquiries and lost or stolen cards, issues and requests for an increased credit limit, and more.

· Credit Card Issuer Identification Number

A credit card's issuer ID number (IIN) typically comprises the initial eight figures of the card number. It determines the credit card network as well as the issuer of credit cards. Also, the IIN numbers aren't unique to the credit card you use. They will be used to identify the IIN that will facilitate financial transactions on the account. Numbers that match the IIN will be exclusive to your particular budget.

Conclusion

Credit cards are now becoming more widespread, and a lot of us are acquainted with these cards. You are able to borrow money and pay effortlessly. If you do decide to issue a credit card, there must be an obligation from the bank since it is the bank that is granting you credit with a credit card. So, for that reason, banks need to verify your balance as well as any other item that has been redeemed before the credit card is issued.