If you are in a quest to understand a merchant bank and search for a question that “What Is a Merchant Bank? You have come to the right place. A merchant bank has always been a financial institution that provides commercial banking and investing services to its clients. A merchant bank is a financial institution that provides a wide range of services, such as underwriting, lending, and crowdfunding. Merchant banks only serve a select group of clients and do not provide their services to the broader public. High-net-worth individuals and huge organizations may benefit from these offerings. High-net-worth people may benefit from the services of a merchant bank, which is a kind of investment bank. Unlike modern banks, merchant banks focus on international commerce and provide specialized services.

Is There A Process For A Merchant Bank to Follow?

Financial institutions known as "commercial banks" in the U. S. handle major transactions and foreign business. Citibank, J.P. Morgan, &'' Goldman Sachs are some of the most well-known global merchant banks. In the United Kingdom, merchant banks are referred to as investment banks, and they provide services to company owners that own many enterprises as well as huge organizations. International finance and overseas investment are specialties of merchant banks. They provide underwriting and other transactional services to their customers. It's common practice to use a merchant bank when a business from Great Britain seeks to buy or purchase another business in Japan.

What Is The Role of Merchant Banks in Trade?

Banks specializing in international commerce and managing corporate accounts are known as "merchant banks." Due to merchant banks' role in facilitating and financing cross-company transactions, huge organizations have grown to rely on them heavily. One way a merchant bank might lend money to companies is via the use of a letter of credit, which allows the latter to acquire a business outlet. There are no geographical restrictions on who may receive money for a transaction while using the LOC. So, a corporation in Great Britain may pay a Japanese vendor for a transaction they made there.

Merchant Banks V / S Investment Banks

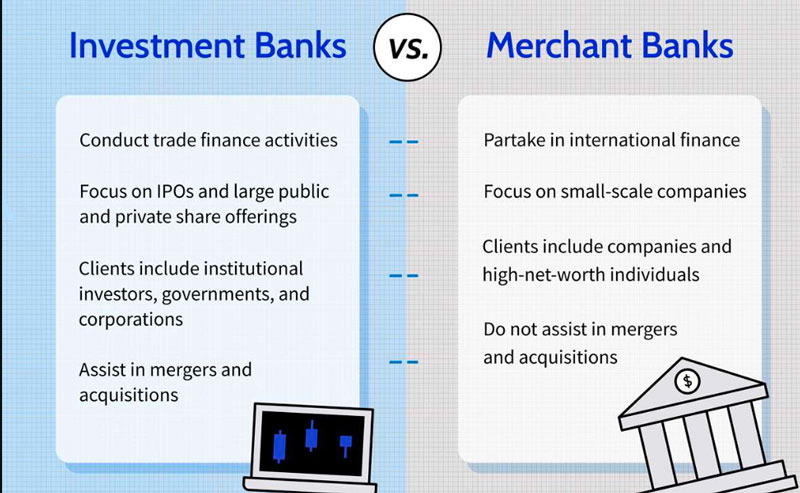

A merchant bank, as well as an investment bank, share certain characteristics, but they also differ in important ways. In general, none of these financial institutions accepts deposits from people or offers personal checking accounts. In an IPO, an investment bank acts as a financial intermediary by purchasing freshly issued shares of a company and then offering them for sale to the broader public. A merchant bank acts as a conduit for firms that are unable to seek capital via an initial public offering (IPO). Investment and merchant banks provide their clients with a wide range of services. Investment banks, for example, perform mergers and purchases for corporations and provide financial transaction advising services. In addition to these, merchant banks offer underwriting, lending, advising, and other services. In return for a charge, both merchant and investment banks provide their products and services. Here are some functions to keep in mind when it comes to a merchant bank.

Functions of a Merchant Bank

Let's take a closer look at each service:

Counseling for a Project

Every step of the way, merchant bankers are there to help their customers, from the first stages of brainstorming through the last stages of budgeting and financing. With new businesses, this is much more prevalent.

Leasing

Clients may rent assets and infrastructure from the banks, which the banks make available via leasing programs.

Management of Issues

Wealthy persons use merchant banks to provide equity, premium, and debenture shares to the public.

Underwriting:

Aside from lending, banks also assist in the sale of stock. They evaluate the price and risk associated with certain security and then begin the public offering and stock distribution process.

Obtaining Funds

Bankers provide a variety of services, including underwriting and the issue of securities, to assist private enterprises in raising money from both local and foreign markets.

Management of a Portfolio

These bankers invest on their customers' behalf in various financial instruments.

Loan Syndication

These banks provide money in the form of short-term loans to businesses in need of capital.

Publicity Campaigning

A merchant bank promotes new business ventures as an intermediary in the financial sector.

Merchant Bank's Importance

It's the bankers' job to assist small and medium-sized firms in getting the financing they need from investment firms and bankers. Enterprises that can't afford the high flotation charges of the financial markets or the larger investment banks rely on them heavily.

When it comes to corporate and project guidance, merchant bankers are constantly needed. A bridge or mediator between savers who seek high profits on their investments and fund consumers who want to spend the money for better objectives, they operate as a conduit for the funds.

FAQs

What Are The Benefits of Merchant Banking?

Companies may use a wide range of services the banks provide. These include things like credit syndication and underwriting, as well as portfolio management and venture capital funding.

Are You Able to Accept Credit Cards Using PayPal?

Indeed, PayPal is a branch of a merchant account, allowing customers to make global transactions for a cost. There is a business financing option, as well.

Conclusion

A merchant banker is a third party that aids in the transfer of cash from market players with excess funds to entrepreneurs in need of capital. Both mezzanine financing and bridge financing are two ways they assist small enterprises in raising capital.