Introduction

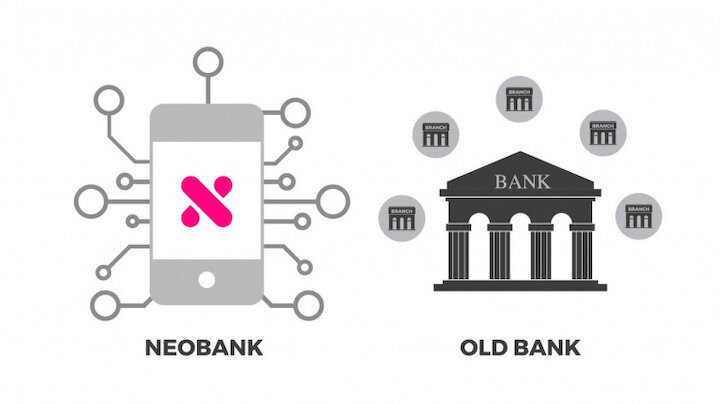

What is a Neobank? New financial technology companies, or "neobanks," aim to make mobile and online banking more streamlined for their customers. This fintech typically focuses on one type of financial service, such as bank accounts. Although many works with megabanks to insure their financial products, these smaller financial organizations are typically more elegant and transparent. These financial technology companies are most frequently known as Neobanks in the United States. The term "challenger bank" was coined in the United Kingdom to describe the plethora of new fintech banks that had cropped up in the wake of the Great Recession of 2007–2009.

How Does a Neobank Work?

How to start a Neobank? The term "neo" describes something novel or recent. These are virtual banks of the 21st century; there is no physical branch of these institutions. Payments, wire transfers, lending, and other monetary services are available through their mobile-first digital platform. But how to open a Neobank? Customers can put money in and take it out quickly. They provide a variety of services, including investment options and debit cards. Also, they have a lending and credit service. Yet, most Neobanks are not authorized to conduct banking activities. Most Neobanks work with traditional banks since they lack the regulatory framework to operate independently.

Advantages Of Neobank

Neo-banks provide their consumers with many advantages due to their digital nature, including:

Hassle-Free, User-Friendly, and Easily Accessible

One way the tech-driven nature of neo-banks improves the user experience is by simplifying the account-opening process. Neo-bank customers can avoid leaving their homes' convenience by opening accounts using their mobile devices. The account may be activated in a matter of minutes, thanks to their tech-driven KYC process. The layout of the neobank app is simple, well-structured, and intuitive. Their responsiveness and customer-centric design are outstanding. For its users, the app's accessibility is a significant selling point.

Quick International Payments

It is only sometimes possible to obtain a debit card that can be used anywhere in the globe or complete the necessary overseas transactions through a conventional bank. We need to request an upgrade to get our hands on an international debit card. If you switch to a new bank, you won't have to deal with that bother. You can use your card overseas at the current currency rate to make purchases or handle transactions.

Personalized Experience

Direct financial transactions are made possible by neobanks. Your account history and current balance are automatically updated in real time. All your financial dealings and transactions are clearly shown within the app, so there's no need to go elsewhere. The neo-app summarises your expenditure and lets you choose a realistic savings target. Thanks to this, you may work more innovative and better manage your cash.

Business Friendly

Finally, neobanks are accommodating to commercial interests as well. Businesses sometimes must endure lengthy, laborious processes regarding cashing checks and making other forms of financial distribution. On the other hand, Neo-banks eliminate the need for these intermediaries and provide direct access to the payout information you need to make sound business decisions.

Popular Neobanks

Incredibly numerous Neobanks can be found today. A Forbes Advisor article recently laid out the benefits and downsides of some well-known online banks. You'll find a variety of Neobanks and "hybrid" platforms that provide similar digital services but are affiliated with traditional financial institutions on this list. This article will look at a few of the most well-known Neobanks currently available.

Chime

With its 12+ million members, Chime is undoubtedly the most well-known Neobank in the United States. This platform does not require many of the fees connected with traditional banks. Chime also has automated savings tools with a competitive yearly percentage rate, the ability to build credit, and early access to direct deposit payments (APY). Chime is a non-banking financial technology startup. The Bancorp Bank and Stride Bank, N.A., Members FDIC, provide checking accounts and debit cards.

Varo Bank

Neobanking was the inspiration for the creation of Varo Bank. In 2020, however, the Office of the Comptroller of the Currency (OCC) granted the company a full-service national banking license, transforming it from a financial services provider into a bank. The service is comparable to Chime in that it does not charge its customers monthly or overdraft fees or mandate that their accounts maintain a specific minimum balance. There is no mandatory credit check for new users.

Current

Another Neobank with tens of thousands of American customers is Current. It provides perks, including early direct deposit access, no overdraft fees, and cash rebates on debit card transactions.

International Challenger Banks

Challenger banks in the United Kingdom include Revolut, Starling, and Metro Bank, with the latter two having recently made their American debuts. German N26 and Brazilian NuBank are two additional international competitors.

Conclusion

The advent of the digital age brought with it the problems inherent in the traditional banking system, prompting the rise of neobanks. Though there may be temporary setbacks, this trend will be around for a while. That's encouraging because the business sector has been crying out for increased inclusivity and diversity for some time n