Subprime auto loans are auto loans that are targeted at borrowers who have low incomes, bad credit, or no credit at all but who nonetheless need borrowing money to purchase a vehicle. Credit scores are perhaps the essential consideration when it comes to being accepted for an auto loan. Your interest rate will be cheaper in proportion to how good your credit score is. However, the greater your interest rate, the worse your credit score will be.

As of the first quarter of 2020, the average annual percentage rate (APR) for an auto loan for a new automobile for someone with prime credit was anywhere from 3.65% to 4.68%. On the other hand, the average annual percentage rate (APR) for a person with subprime credit ranged from 11.92% to 14.39%. An annual percentage rate (APR) on a subprime auto loan might go as high as 29%.

Let's examine two loans with the same sums, down payments, and loan periods but different APRs. One is an example of a regular auto loan with an APR of 3.65%, while the other is an example of a subprime auto loan with an APR of 14.39%.

Compared to a standard auto loan, the monthly payment required for a subprime auto loan will be much higher in this scenario. When it was all said and done, the total cost of interest charged on the prime loan would be $2,760.18, but the total cost of interest charged on the subprime loan would be $11,968.58.

How Subprime Auto Loans Work

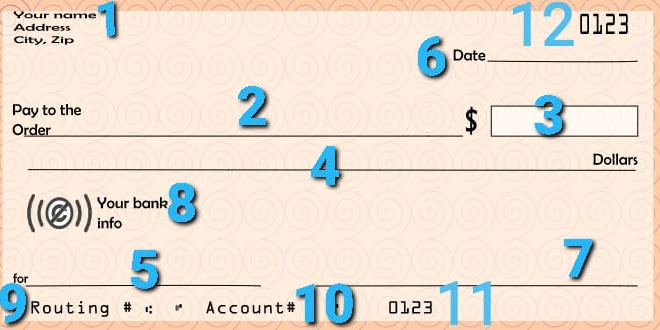

The steps in obtaining a subprime auto loan are quite similar to those in obtaining any other kind of loan. In most cases, you can apply for a loan online or in person at a financial institution by filling out a form with your fundamental personal information and submitting it.

When you apply for an auto loan, the lender will run a credit check on you to determine whether or not you are qualified for a loan and, if so, at what interest rate. The approval or denial of an auto loan is often contingent on the borrower's credit history. Borrowers with subprime credit scores, defined as scores lower than 619, are eligible for subprime auto loans. Those with good credit scores are not eligible for subprime loans.

If you have a poor credit score, securing an auto loan may not be impossible, but the interest rate you pay will probably be much more than what you would pay on a standard auto loan. The final effect for some individuals is that they have more difficulty paying off the loan and spend more on interest overall.

Your credit score will take a hit, and there is a chance that your vehicle may be repossessed if you are late on your payments for an auto loan. Depending on the lender, the loan rates and fees associated with subprime auto loans might be higher than those associated with standard auto loans. They are as follows:

- An origination fee is a processing cost charged when a loan is taken out.

- A penalty levied against you if you pay off your loan before the conditions agreed upon for the loan is known as a prepayment fee.

Pros and Cons

Subprime auto loans may be able to offer funds for customers who are not eligible for standard loans; nevertheless, the interest rates on these loans are often rather high. Consider each option's benefits and drawbacks before selecting which is best for you.

Pros

- Loans for people with poor credit: If you have poor credit or not a lot of credit to your name, a subprime auto loan may assist you in purchasing a vehicle when you really need one.

- Loans for low income: In a similar vein, if you have a poor income, you may discover that a subprime loan is the only option to finance a vehicle.

Cons

- A high-interest rate is often associated with subprime auto loans since interest rates on these loans are typically substantially higher than those associated with standard auto loans. If you pay more interest each month, you will spend more overall money throughout the loan's duration.

- Extremely high-interest rates may make it impossible for you to qualify for a loan, even though you may be able to get one. This is because you may not be able to afford the extremely high interest rates and monthly payments.

- Possibility of repossessing your property because of falling behind on payments brought on by rising interest rates and monthly fees. If you cannot make a payment on time, the lender has the right to reclaim the vehicle.