When vendors have info that buyers don't, or vice versa, concerning the product's quality, the term "adverse selection" is used. In other words, asymmetric information is being utilized in this instance. It's termed information failure whenever a participant has more material understanding than the other party. Asymmetric information when buying a home, the seller is often the one with a more incredible experience.

Both parties have the same amount of information with symmetric information. Those who work in high-risk jobs or lead risky lives are more likely to obtain life insurance. It is the buyer who has better knowledge in these circumstances. Insurance firms limit coverage or raise rates to combat adverse selection to limit their exposure to significant claims.

Acquainting Yourself With the Concept of Adverse Selection

An example of adverse selection is when one side possesses pertinent knowledge in a negotiation that the other party does not possess. As a result of the asymmetry of information, businesses often make poor decisions, such as expanding into less profitable or risky markets. To minimize adverse selection in the insurance market, it is necessary to identify and charge higher premiums to groups of people who are more at risk of victimization.

Life insurance firms, for example, use underwriting as a means of determining whether or not to issue a policy and how much to charge for it. An applicant's height, weight, present health, medical records, family medical history, job, pastimes, driving records, and lifestyles risks such as smoking all affect an applicant's health and the company's ability to pay a claim.

After that, the insurer decides whether or not to provide a policy to the applicant and how much to charge due to taking that hazard.

As a Result of Unfair Competition In the Market

The buyer may be at a deficit in a transaction because the seller is more able to provide products and goods being supplied. For example, corporation executives may more gladly post-fault when they realize the share value is overpriced compared to actual worth; consumers can buy assets and lose money. This can happen in the second car market, where a seller may be aware of a vehicle's flaws but choose not to disclose them.

Insurance-Related Adverse Selection

As a result of adverse selection, insurance companies discover that high-risk individuals are more likely to purchase policies and pay higher rates. Paying out some more benefits or claims means the company loses money if it charges a standard price but exclusively attracts high-risk customers. By raising rates for high-risk customers, the insurance carrier has more money to pay out those benefits.

For example, race car drivers pay more for life insurance because of the higher risk they represent. Those who live in areas with a high crime rate are charged more for vehicle insurance by a company. Customers who smoke are subject to higher premiums from their health insurance provider. As a result of rising insurance premiums, individuals who may not engage in risky activities are less prone to shop for insurance.

Adverse selection in life and health insurance is best shown by the case of a smoker who can secure protection as a former smoker.

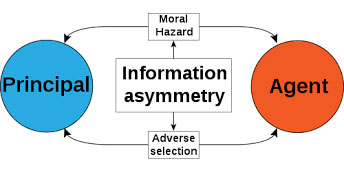

Adverse Selection vs. Moral Hazard

In the same way, adverse selection happens, moral hazard occurs when a party's conduct changes after a bargain are formed but with asymmetric information between the parties. If the buyer and seller do not have the same information before making a deal, it is known as adverse selection. As the name suggests, this occurs when there is uncertainty about whether one of the parties agreed to the deal in good faith or gave incorrect information about their financial resources or creditworthiness. Bank employees take on excessive risk to earn significant bonuses since they know that if their hazardous bets don't pay off, the government regulating authorities, such as the Federal Reserve, will just save the bank.

Having Lemons In Your Life

If the information on a product or investment isn't evenly distributed between buyers and sellers, it's known as the "lemons problem." George Akerlof, a professor of studies at the University of Texas, Berkeley, first raised the issue of quality uncertainty in the market for "lemons" in a research article he wrote in the late 1960s. The scenario of used vehicles inspired the problem's tag line.

Using the term "lemon" as a metaphor for asymmetric information, Akerlof contributed to understanding asymmetric information. Many financial industries, including insurance and credit, face the same lemons problem. For example, incorporating finance, a lender knows a borrower's creditworthiness that is asymmetrical and less than perfect.

Economics: A Comprehensive Approach

With experts from throughout the world who can quickly master even the most rudimentary concepts in economics. Udemy will help you learn the distinction between microeconomics and macroeconomics, so you'll be able to apply what you've learned to the real world.