Sometimes, it is referred to as an account routing number; ABA transit numbers were invented through the American Bankers Association in 1910 to mark the endpoints of processing checks. Since they were created, the numbers' use has expanded to include all participants in clearing checks between banks, automated clearinghouses, and online banking transactions. These numbers can also be utilized for Fedwire payments, and every number that makes up an ABA routing number is an integral part of the process.

The initial four digits indicated the bank's physical location as determined by the Federal Reserve Routing System. With the advent of 2019 and the frequent bank mergers and acquisitions, they may not be a physical location. The following two numbers indicate what the Federal Reserve bank responsible for routing the transaction electronically is. The seventh digit of the code identifies the Federal Reserve check processing center for the bank. In contrast, the eighth digit represents that of the Federal Reserve district the bank is located in.

How to Find and Use ABA Numbers

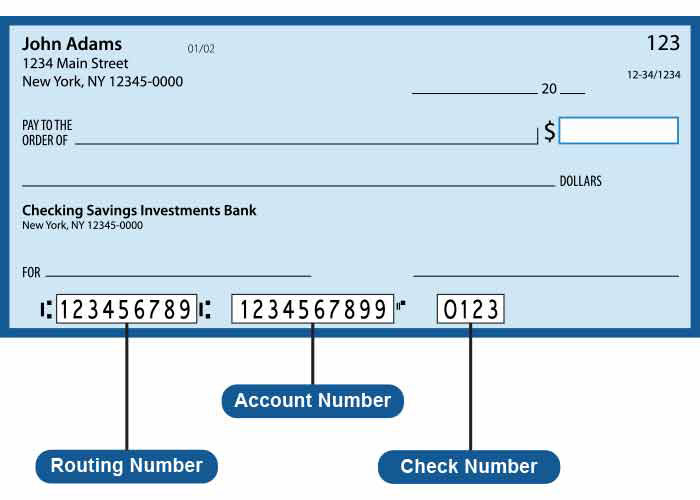

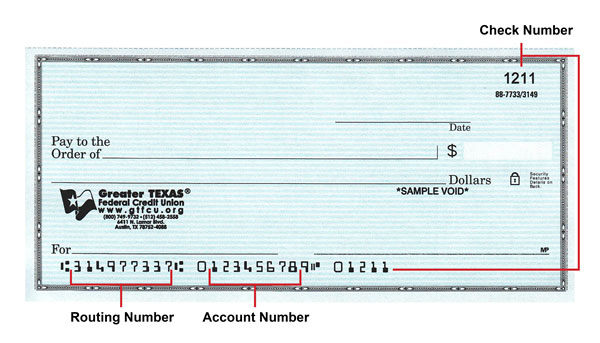

You can locate a bank account's ABA number from various sources. If you've got a checkbook in your pocket, the simplest method is to find the number at the bottom of your checkbook.

On Paper Checks

An ABA number appears on every check. For personal checks, it's usually the 9-digit number located at the bottom left corner. The number could appear in other places on computer-generated checks (like online bill payments and business cheques). You may also see the ABA numbers on your deposit slips generally in the same spot.

Contact Your Bank

Some banks will provide the information online; however, you may need to log into your account to access the correct number. Check your bank's website to find direct deposits and Automated Clearing House (ACH) information. You can also call customer service and inquire.

Use the Correct Number

The bank you work with could have various ABA numbers; therefore, it is essential to determine the one specifically associated with your particular account. ABA numbers can differ based on where you have opened your account, and bank mergers may create multiple code numbers. Certain banks may also have distinct ABA numbers for wire transfers vs. direct deposits or ACH transactions. Even if it is the correct number to order checks, you may require an alternative number for a wire transfer or electronic bill payment. If you're not sure, contact a customer support representative at your bank for the number to make use of.

Usage

Financial institutions (including credit unions and banks), bank customers, and money transfer services use ABA numbers containing bank routing numbers. ABA numbers are utilized to facilitate the clearing of check payments electronically ACH (Automated clearing house) transactions to U.S. financial institutions and some wire transfers. The types that make up ACH transfers include direct deposits, automated payment of bills, electronic vendor payment, and other B2B transactions and payments made person-to-person.

Suppose you have personal loans, like mortgages or corporate loans; you'll have to give your bank account's ABA number to get the loan to receive the funds. Wire transfers and ACH transactions are electronic funds transfers (EFT), also known as electronic payments. They allow you to transfer funds between the recipient's and payer's accounts at banks. ACH transactions are less susceptible to scams and fraud threats than wire transfers.

Are ABA Routing Numbers The Same Thing As US Routing Numbers?

An ABA routing code is usually known as a "routing number" or US routing number. However, certain financial institutions and banks might recognize the code as an account routing number for banks or the Routing Transit Number (RTN). This may confuse some people, particularly since some banks within the UK might refer to it using one of these terms. But, the terms are interchangeable, and all refer to the identical ABA Routing Number. This could confuse some people, particularly because institutions in the UK could refer to it with some terms. But, the terms are interchangeable, and all refer to the identical ABA Routing Number.

International Payment

If you want to make an international payment into a banking account within the United States, you will have to obtain the ABA Routing number for the account you intend to transfer the money to. This is required for those who wish to send your payment via Fedwire or a similar service. It can also be used in lieu of a requirement when you make your international payment via the SWIFT system and provide a BIC or SWIFT code. This makes it simpler for the bank you use to determine the bank receiving the payment.