Ex gratia payments are made to a person by a company, the government, or an insurer to make up for losses or claims; the payer is not required to acknowledge liability.

Due to the recipient's lack of legal obligation to accept payment, an ex gratia payment is considered optional. Ex gratia is a Latin phrase that means "by favour."

Damages or Claims

Ex gratia payments are made to a person by a company, the government, or an insurer to make up for losses or claims; the payer is not required to acknowledge liability. Due to the recipient's lack of legal obligation to accept payment, an ex gratia payment is considered optional. Ex gratia gifts are commonly subject to federal and state income taxes in the United States.

A Guide to Ex Gratia Payments

Ex gratia payment is different from legally required payment in that it is not required. Unless required by law, businesses, governments, and insurance providers frequently decline to provide compensation to victims. Therefore, ex gratia payments are not particularly common.

The insurance company is compelled by law to pay for the claim if the policyholder sustains an injury covered under the terms of their insurance policy. This type of payment is necessary. It results from a legal requirement and typically includes an acknowledgement of guilt.

A company may offer ex gratia payments when the recipient has experienced a loss; nonetheless, such a transaction is not considered an admission of liability.

Paying someone is a gesture.

Conversely, an ex gratia payment is a gesture of goodwill. Ex gratia payments are made without any admission of guilt in response to a specific loss or damage to property. A business will not be considered to make an ex gratia payment if it compensates customers once for a specific loss. However, if a company provided a credit due to a service outage, it would be considered to have made an ex gratia payment.

An organization may employ ex gratia payments as a part of a longer-term strategy to maintain the recipient of the payment in good standing. For example, a large business forced to lay off employees may provide severance pay larger than what is allowed by law. The shop might conclude that the negative publicity that the layoffs will generate will be lessened by doing this wonderful deed.

Specific Considerations

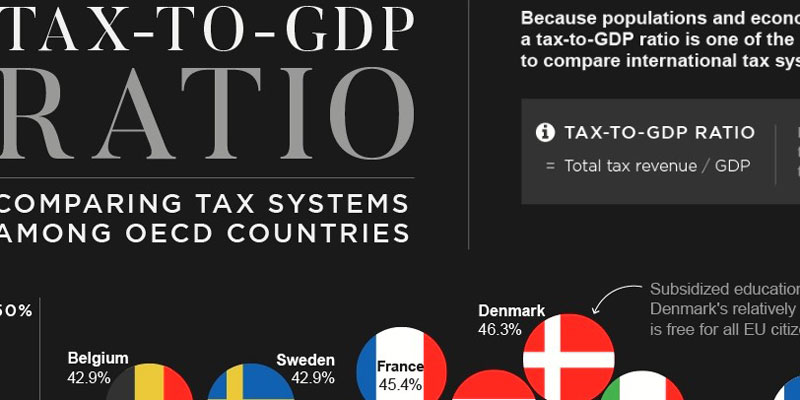

Ex gratia gifts are commonly subject to federal and state income taxes in the United States. Ex gratia payments under £30,000, however, are not subject to taxes in the UK as long as no work or services were rendered in exchange for the funds.

Taxpayers in the UK must notify Her Majesty's Revenue and Customs (HMRC) of the payment at the end of the tax year to ensure they won't be obliged to pay any income tax or national insurance on it, even though the first £30,000 of an ex gratia payment paid to you is tax-free.

Why Are There Ex Gratia Payments?

The insurance provider is not obligated to reimburse you if your claim is rejected in accordance with the provisions of your policy.However, the following circumstances might induce the insurance company to voluntarily make you an ex gratia payment to make up for your loss:

The insurance company may give you this money instead of defending you in court if you file a lawsuit and it is determined that doing so will be more expensive. This decision results in cost savings for the insurance.

Similarly, if your policy language is unclear and there is a strong case from an insurance coverage attorney, your insurer may decide to pay part or all of the claim to avoid going to court.

The insurance company is worried about losing your business, especially if you are a dependable, consistent, high-premium customer. The insurance company may give a voluntary contribution as a goodwill gesture to win your business because it doesn't want to lose it.

What Does Receiving Ex Gratia Payments Mean to You?

Even if an insurer denies your claim, you could still be able to receive money from your insurance provider using this strategy. Additionally, since they aren't required by law, you shouldn't count on receiving one of these settlements to assist in making up your losses. Having the appropriate types and amounts of insurance in place is preferred so any claims may be handled according to schedule.

Ex gratia payments have tax repercussions in different jurisdictions. If you get one from your insurance company, it could be a good idea to consult a tax accountant to find out if you have to pay taxes.