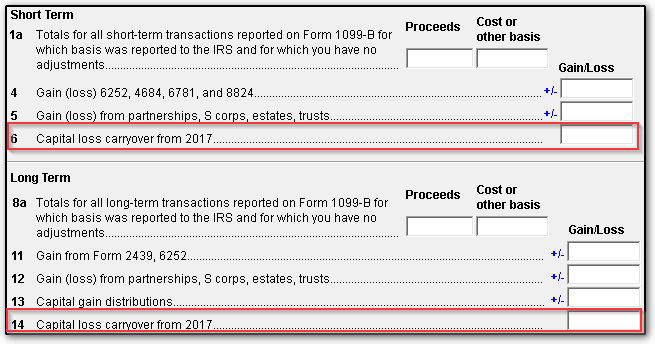

Capital loss carryover refers to an investor's net loss into a future tax year. Net capital loss refers to the higher sum than any capital gain after offset capital losses. In the United States, the Internal Revenue Service allows a maximum deduction of $3,000 within one financial year. If the capital losses exceed the maximum amount and exceed the limit, the IRS permits the investor to carry them forward to future financial year until it is exhausted. However, the IRS will not permit the investor to select what year they'll compensate for the carryover loss. If the investor misses an entire year and does not offset the loss, the forfeiture is permanent.

Working

Tax laws on capital losses minimize the harm that these losses could later have. However, these provisions come along with them certain exceptions. For instance, investors need to know about the wash sales clause. The wash sale rule halts an investor's loss when they purchase identical securities for 30 days or more before selling the securities at losing. The rule prohibits investors from claiming their full loss on their tax returns. The result is that investors cannot add the loss to the expense of the purchase, which will reduce the potential capital gains.

Understanding Capital Loss Carryover

Tax provisions for capital losses lessen the effects of loss of investment. However, the rules are not without exceptions. Investors should be aware of wash sale clauses prohibiting the repurchase of investment within 30 days after selling it for loss. In the event of this, the capital loss can't be used to calculate tax and instead is included in the price basis of the new investment, which reduces the impact of any future capital gains.

Tax-Loss Harvesting

Tax-loss harvesting can be a way to increase the return after tax on tax-deductible investments. It's the practice of selling securities for a loss and using the profits to offset tax-free the gains of other investments and income. Based on the amount of loss gathered, the losses may be used for use in subsequent years. Tax-loss harvesting is typically done on December 31st, which is the final day to take an investment loss.

Taxable investment accounts track gains that were earned during the previous year. The investor is looking for lost profits that are not realized to offset these gains. This allows the investor to not pay as much as possible in capital gains tax they can. If the investor plans to buy back the identical investment, they have to wait until 31 days before they can avoid the wash sale. The investor might opt to trade the stock before the year's close to recover the loss. Should the ABC Corp stock be sold before or on 31 December, the buyer will earn $1000 ($10,000 gains minus the $9,000 loss of ABC Corp loss) in capital gains. If you follow the wash-sale principle, if the stock was purchased on 31 December, the buyer must wait until January 31st to buy it back.

Capital Loss Indefinite Carryover

It is important to note that the Internal Revenue Service does not have a set limit on the amount of time an investor can spend to recover their net losses. If this is a poor season for stock markets and you decide to sell part of your stocks or bond, you will realize a loss of $20,000, with no capital gains. In the beginning, you could apply the IRS limit, which is $3,000, to reduce the income in the year and keep $17,000 for the next year. The next year, you will be able to claim capital gains of $5,000. You could offset the capital loss by adding this capital gain and the $3,000 of the IRS limit on income and carry over $9,000 for the tax year following.

If you don't make any gains in the next year, you can keep taking your normal income and subtracting it from the capital loss until you have exhausted it. Another instance is where an investor earns $500 and can incur a capital loss from selling assets. The loss is not tax-deductible even after deducting the $3000 capital losses. Investors do not wish to use the money to reduce the capital loss of this year and instead move it forward into the following year. In this case, the tax return will contain the deduction of $3,000 on capital losses, and because the income isn't sufficient, it is possible to carry forward your loss to the next year.