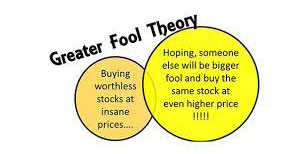

According to the "greater fool" argument, prices rise because people can sell expensive securities to a "bigger idiot" regardless of whether they are overvalued. As long as there are any more fools left. The more extensive fool theory holds that investing entails ignoring market valuations, quarterly results, and other relevant information. People who believe in the more excellent fool thesis could've been left clutching the baggage after one correction if they ignored the fundamentals.

The Greater Fool Theory Hypothesis

An investor who follows the more excellent fool principle will buy stocks at high prices regardless of whether or not they are suitable investments. A "greater fool" may buy them from the investor, who, if the idea is correct, can rapidly sell them to another "greater idiot." Inevitably, speculative markets bust, resulting in a sharp drop in stock values. The more excellent fool hypothesis is wrong in various situations, including economic downturns and depressions, as well.

When the market fell in 2008, it was challenging to find buyers for investors who had purchased bad mortgage-backed securities (MBS). In 2004, the homeownership rate in the United States reached a record high of just under 70%. A 40 percent drop in the U.S. House Building Index occurred in 2006 due to falling home prices in late 2005. As interest rates rose, many subprime mortgages could not keep up with their payments and defaulted.

One trillion dollars' worth of subprime mortgage securities owned by banks and hedge funds also triggered a wave of concern.

Intrinsic Valuation and The Greater Fool Theory

The fact that MBS was based on such low-quality debt was one of the causes of the difficulty buyers had in finding amid the 2008 financial crisis. There are times when a valuation model may be necessary to identify the actual value. The word "due diligence" comprises a wide variety of assessment analyses.

In addition to determining a company's capitalization and total value, due diligence can also include tracking revenue, profit, margin, and other financial metrics like PE, P/S, and P/E/G to see how the investment fits into the market as a whole, as well as looking at the company's historical performance (PEG).

Investors can also study the impacts and techniques of management's decision-making via a capitalization tabletop that breaks down who owns the most organization shares and has the most potent voting power.

A Good Illustration of The "Greater Fool" Theory at Work

The Greater Fool Theory often uses Bitcoin's price as an example. In addition to using enormous amounts of energy, the cryptocurrency appears to have no intrinsic value and consists of computer code stored in a network. On the contrary, bitcoin's cost has risen dramatically in recent years. It reached a high point of $19,999 at the end of 2018 but then began to decline. Investors and dealers bought and sold bitcoin at a quick pace to profit from its price rise, with many claiming that they were hoping to resale it at a higher price later.

Demand for bitcoin outstripped supply in a short time, allowing the price to rise rapidly. In 2019 and '21, Bitcoin reached new highs, breaking the $59,999 mark and remaining for weeks over the $50,000 mark. There is still debate whether or not the buyers this time around should be termed idiots because they include substantial institutional investors and firms like Tesla and PayPal. Maybe the larger fool argument doesn't apply to Bitcoin after all.

Does the Larger Fool Technique Make Sense For You to Use?

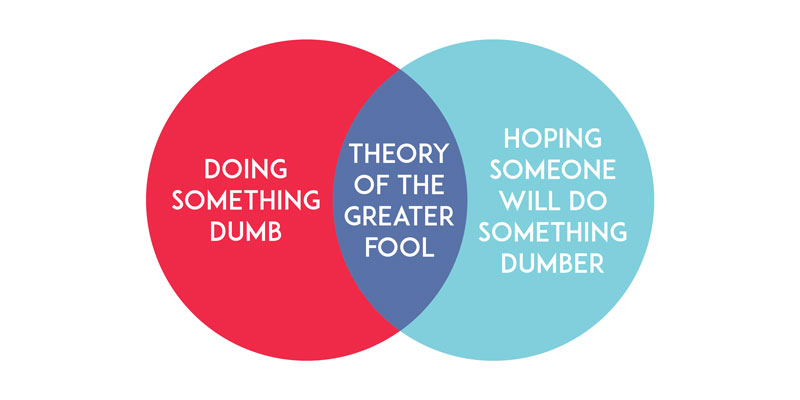

There is overwhelming evidence that more giant fools exist when it comes to investors. However, this is not a prudent course of action for long-term investors. It takes a lot of time and effort to successfully deploy a more considerable fool technique. Market trends can change in minutes, so traders must keep a close eye on them. Most consumers (and financial advisors) lack the time and money to devote to such an endeavor.

Investors without the speculative and market-trend experience of comprehensive day traders typically cannot implement the more extensive fool method. Even if you believe in The Greater Fool Theory, there is a high danger that your client(s) will be the greater fool and lose all of their money. When the music stops and the bubble breaks, you don't want your client to be left standing without a chair.

Your Consumer Wants to Acquire An Overvalued Stock; What Should You Do?

Academics and financial experts have long established that stock returns are "mean-reverting," which means that stock prices fluctuate but eventually return to their mean/average price. Eventually, the market of a "hot" stock will fall if it rises too much above its mean. Remember that no one has a magic ball to foresee when a financial bubble will burst or a given stock's mean reversion.

This can be helpful in these cases. The more excellent fool method is speculative, and they don't want to be left holding the towel because there are no more idiots to sell to it at a higher cost.