Income smoothing is an accounting technique that helps balance net income fluctuations between periods. This practice is common because investors will pay more for stocks with predictable and steady earnings streams than stocks subject to volatile patterns. These stocks can be considered riskier. It is legal if the income smoothing process is done by generally accepted accounting principles (GAAP). Highly skilled accountants can adjust financial books to ensure income smoothing is legal. Income smoothing can often be done fraudulently.

Understanding Income Smoothing

Income smoothing is a technique that reduces fluctuations in earnings. It is used to present a company with steady earnings. Smoothing income is used to reduce periods of high and low income or those with high expenses and low income. This is done by accounting professionals moving revenues and expenses around legally. Income smoothing techniques include deferring revenue in a good year if it is expected that the next year will be difficult or delaying recognition of expenses in difficult years because of expected improvements in performance.

Companies planning to raise capital from private equity investors or venture capital might delay spending in certain years. A high EBITDA due to income smoothing could translate into high valuations using multiple EBITDA calculation methods. Although it may seem counterintuitive to slow down revenue recognition in a good year deliberately, entities with predictable financial results typically enjoy lower financing costs. It is often a good idea for businesses to have some accounting management. It's not easy to distinguish between what the Internal Revenue Service (IRS) allows and what is deceitful.

Income smoothing doesn't rely on "creative accounting" or misstatements that would be considered fraud. It relies on the flexibility provided by GAAP. Businesses that use income smoothing are ethically and fairly managed and do not usually raise red flags.

Significance of Income Smoothing

Income smoothing is a technique that reduces variability in earnings over time. This helps to make an organization appear stable and earn more. It smoothens out periods of high income and low income, or high spending and low expenditure. This is done by accounting professionals delaying or moving the recognition of income and spending. Income smoothing strategies could include delaying sales in a successful year if it is likely to be difficult the next year or delaying spending when efficiency is expected to increase shortly.

While it may sound counterintuitive to delay revenue recognition in a good year, companies with predictable financial results can negotiate better terms for their loans. If profits are moved to a later period, companies may be able to defer large tax liabilities. Income smoothing by misusing accounting policies, deception, or misstatement is not by professional standards. Some income smoothing is possible thanks to professional judgment and flexibility in GAAP or IFRS accounting policies.

Reasons For Income Smoothing

Income smoothing can be done for many reasons. This could be to lower its taxes, attract new investors, or as part of a strategic business move.

Reduce Taxes

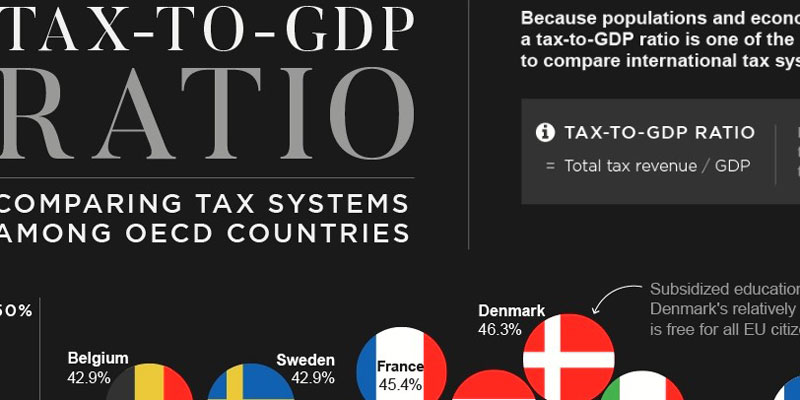

Companies pay a progressive corporate rate depending on where they are located. This means that companies pay more taxes for higher income. Companies may raise donations to charities or increase losses provisions to avoid this. Both of these options would offer tax benefits.

Attract Investors

Investors seek stability in their investments. Investors may not want to invest in a company whose financials are volatile. Investors who are more comfortable with steady returns over a longer period will be attracted to a firm with consistent returns yearly.

Business Strategy

A company with high profits can increase its expenses as a business strategy. This could mean that they pay more to employees or increase the number of workers hired to raise payroll costs. They could also reverse the strategy and lay off employees or reduce bonuses to lower-income. These actions not only smoothen income but also allow companies to operate more efficiently, depending on the situation.

Example

Income smoothing can be described as modifying the allowance for doubtful assets to adjust bad debt expenses from one reporting period. A client might expect not to obtain payments for certain goods in two reporting periods. For example, $1,000 first and $5,000 in the second reporting period.

The company could include $6,000 in the allowance for doubtful accounts if the first reporting period has a high expected income. This would result in a $6,000 increase in bad debt expenses and a $6,000. Reduction in net income. This would smoothen out high-income periods by decreasing income. Companies should use their judgment and legal accounting methods to adjust any accounts.