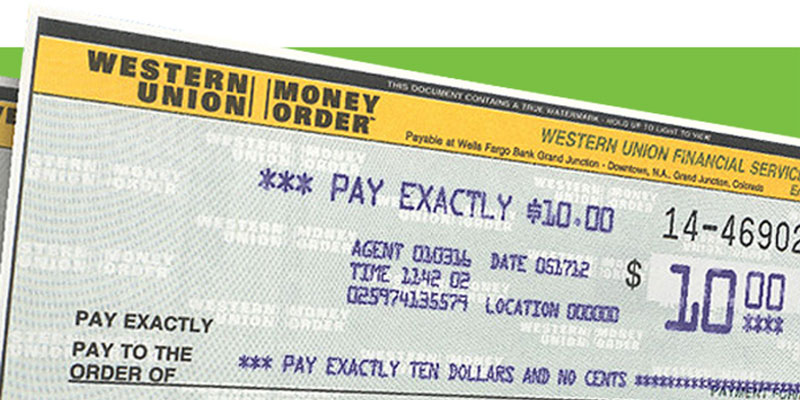

Similar to a check, it is a form of paper payment. But, money orders differ from personal checks because the payment is guaranteed. Contrary to checks, they aren't able to bounce. You purchase money orders using cash or a different type of payment, like an international traveler's check or debit card. It is impossible to buy a money order using personal checks or credit cards.

Additionally, when you purchase money orders, you have to include details of the person paying (the beneficiary). The financial institution that issued the money order must be able to print its name on the money order. Both of these elements on every payment make it impossible for any person other than the recipient to pay for a money order, making money orders more secure than cash and even more secure than certain forms of payment.

It's unlikely that your cash will end up in the hands of a theft ring, regardless of whether the money you've paid for is lost or wrongly directed. However, keep your receipt so that you can trace and retrieve funds if your money order gets lost or stolen. Money orders have some limitations, however. For instance, at the United States Postal Service (USPS), you can't buy money orders that exceed $1,000. If you buy more than $3000 worth of money orders within a single day, you'll need to fill out a specific form and show an ID photo issued by the government.

Why Should I Use a Money Order?

Money orders permit you to transfer and receive huge sums of cash safely and without the need for bank charges. They also safeguard your data. Money orders include your address and name; however, unlike personal checks or certified checks and a certified check, they will not include your bank account details or routing numbers. It's much more difficult for thieves to steal your financial information without these details. It's a good thing because you must ensure that identity theft is as hard as possible. Because as the sad reality is that thieves and fraudsters can steal your identity and money if they are given the opportunity. It's the reason identity theft protection is essential. Every money order comes with a receipt and an identification number to provide additional security.

Can I Purchase A Money Purchase Using A Credit Card?

Certain outlets let you buy a money-order using credit cards; however other outlets don't, such as Walmart and the U.S. Postal Service. You'll need either cash or a debit card to purchase a money order in those instances. If the service you choose allows you to use a credit card to pay, it's much more cost-effective than not. Credit card issuers usually consider money orders as cash advances and charge fees depending on the transaction amount, 3 to 5 percent, and assess the interest immediately. The interest rate could be higher than what you'd pay on a regular purchase.

Disadvantages

While the concept was considered quite appealing and profitable, it has some drawbacks. The payment system received little acceptance and use in the insurance and brokerage sectors due to concerns about how it could be utilized for money laundering. Since the system can be utilized in transactions between businesses between several people and could be used to wash money derived from illegal transactions. For instance, an illegal organization might be able to earn income from several money orders and then declare the revenue through the LLC with limited liability (LLC), which renders this money legal as well as "clean."

Special Considerations

The person who gets the money order doesn't necessarily have to be the same issuer that issued the cash order. According to the institution's policies, the beneficiary can get it cashed at their local credit union or bank and may not receive the money in one go. If the recipient does not have an account, then cashing the money order at the issuer's office is a good alternative. However, the payee is not required to pay the money order immediately. They can transfer it to an account at a bank, just like you would deposit the same with a check. Money orders can be deposited into a bank account. It's an ideal option for people concerned about charges for cashing certificates in multiple locations.

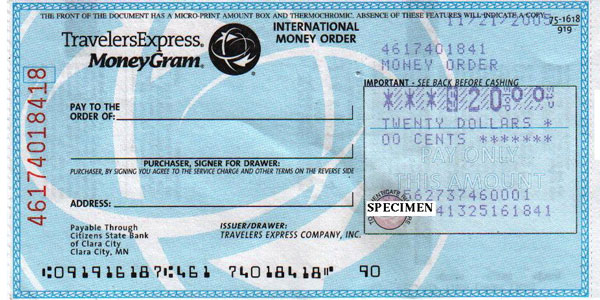

Since the charges are sure to decrease the amount that can be received, putting it in a deposit without any additional costs in a bank will guarantee that your account owner will keep all money they have received. This is usually the case when the money order may be used to transfer funds outside the country. A bank with branches worldwide may issue a money order from one country, which can be cashed in a different country. International money orders are an easy and cost-effective method to transfer money across the frontier.