Payroll deductions are the amount deducted from a worker's paycheck and are taken by the employer. These deductions include insurance contributions to pensions, wages assignment, child support payment taxes, and uniform and union dues. Mandatory taxes are taxes imposed by the government. However, the rest of the deductions are free.

However many hours an employee has been working, deductions from payroll must be taken from checks for payroll. If no deductions are taken, the employer is responsible and liable for any amounts mandated by law that were not to be deducted. When the employee's deductions for insurance are not taken into account, the employer is responsible for paying the deductions or ending the employee's insurance policy. It is always the employer's responsibility to ensure the deductions from payroll are withheld promptly.

Payroll taxes mandated by the government are Medicare tax, Social Security taxes, and federal income taxes. The voluntary deductions are the amount paid for things like 401(k) plans or insurance plans, as well as uniform and union dues. Payments for child support are automatically deducted from the employee's paycheck along with garnishments ordered by a court.

How a Payroll Deduction Plan Works

Payroll deduction programs allow employees to make automatic contributions to any ongoing expenditure or investment. It is, for instance, normal for employees to take the appropriate percentage of their earnings and deposit it into the conventional Individual Retirement Account (IRA) or Roth IRAs. A worker can also decide to have the costs of an insurance policy taken out of their salary, which ensures that the payment will never be missed.

Certain payroll deduction plans could also include the option of voluntary, systematic deductions from payroll to buy stocks of the common stock. In such instances, the employee is enrolled in the company's stock purchase plan, and a part of every paycheck is used to purchase shares of their employer's stock, usually at a discounted cost. In the example provided by the Securities and Exchange Commission (SEC) concerning the Employee Stock payroll deduction Plan offered by Domino's Pizza, Inc. The eligible employees can opt to deduct 1 to 15 percent of their earnings to purchase company stock, priced in 85% fair market value on the choice's date.

How to Calculate Payroll Deductions

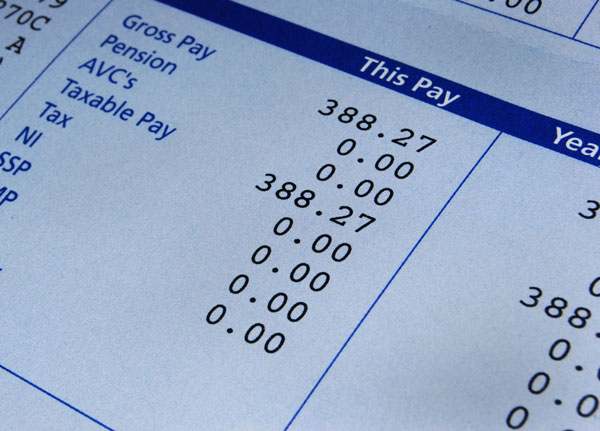

There are two kinds of deductions for payroll: tax-free and post-tax. To determine the take-home pay of an employee, one of the initial steps is subtracting tax deductions that are pre-tax from their gross income, like insurance deductions or retirement contributions. What's the difference? It's the worker's tax-deductible income. Then, determine the employee's tax withholding according to their tax-deductible income. This includes state, federal-local, and federal taxes and Social Security and Medicare withholdings.

Lastly, take out the employee's tax-free deductions, like union dues, some employee costs, or garnishments on wages. These Roth IRAs are also post-taxed, making the contributions using tax-deductible income. After deducting all the deductions and taxes, the outcome is the employees' net earnings that should be included in their final salary.

Pre-Tax Deductions

Tax deductions for pre-tax are subtracted from the employee's gross earnings before the social security and taxes are determined. They are usually used to cover life insurance, health insurance, health savings accounts, and retirement fund contributions. It is also possible to deduct up to $260 in travel costs. Because the money used to make these deductions is not tax-deductible, they could lower the overall tax burden and give them a reason to be a part of these programs.

FICA taxes

FICA taxes are used to support Social Security and Medicare. Employers contribute to Social Security tax at a rate of 6.2 percent, with a contribution limit based on wage, and pay Medicare taxes at 1.45 percent, without limit. This equals 7.65 percent in FICA taxes per paycheque (until you reach the Social Security wage base is exceeded), which is the legal requirement to pay.

Certain employees might be subject to an additional Medicare tax. Beginning during the pay period in the year that an individual's earnings are greater than $200,000, you will have to begin taking 0.9 percent from their wages until the close of the year. Additional Medical Tax is also applicable to certain amounts of railroad retirement benefits and self-employment income. There is no requirement to contribute this deduction.