The value of a property derivative swings in response to changes in the value of underlying real estate assets. For these kinds of financial transactions, well-constructed, broadly-based index contracts are required, which are often based on real estate property indexes. Derivatives are often used by large organizations or knowledgeable investors since they are so difficult to understand. What Is a Property Derivative? Property derivatives include forward contracts, net income swaps, and bonds with the derivative included in the bond structure.

Understanding a Property Derivative

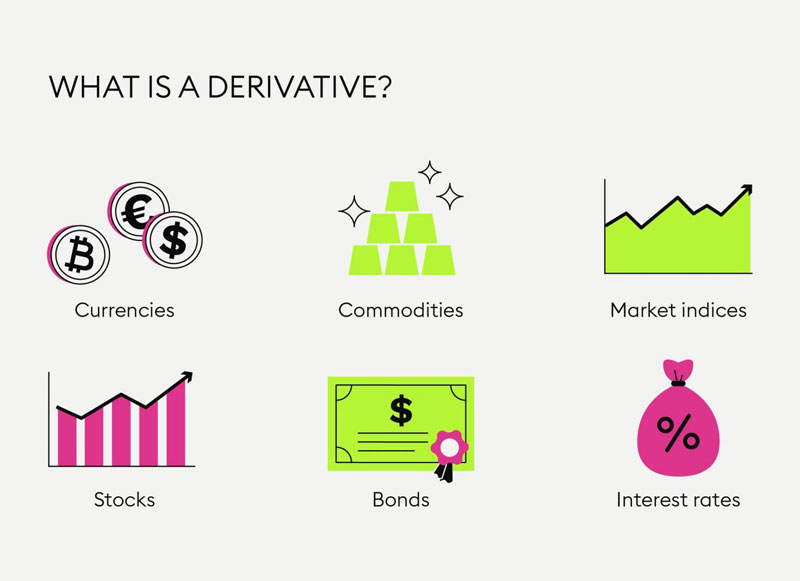

A kind of financial derivative known as property derivatives may be found. Derivatives are structures that draw their value from underlying assets, indexes, or interest rates. Futures, swaps, options, and property index notes are examples of derivatives. To protect against price fluctuations, speculate on price changes with leverage, or obtain access to assets or marketplaces that are otherwise difficult to trade, derivatives are financial contracts.

Property derivatives substitute a real property with a real estate return index, such as the NCREIF Property Index (NPI). Over 9,000 properties are included in the NPI, which is widely used to assess the success of commercial real estate investments. In all U.S. regions as well as real estate land uses combined, the index is valued at around $703 billion as of the 3rd quarter of 2020. It was down 1.7 percent on the index. An index is utilized because it is difficult to correctly and effectively price individual real estate assets. A real estate index aggregates data from the whole real estate market in order to estimate the worth of the underlying assets.

What is Regarded as Property Derivative?

Derivatives are, by definition, agreements between two or even more parties whose value is based on an underlying asset. Financial products or contracts based on real estate assets are known as property derivatives. Note swap, forward, and futures contracts are all examples of this kind of agreement. When it comes to traditional financial instruments such as equities and bonds, property derivatives are a world apart.

How Property Derivatives Work

Investors have the ability to move into and out of all four quadrants of the real estate market by using property derivatives. These quadrants include private debt, private equity, public equity, and public debt. Because it helps them to better control their current real estate asset allocation, they may be able to boost returns. Investment in real estate portfolios may be lowered by using an active derivatives market, which provides a range of risk management options.

Uses of Property Derivatives

A total return swap of something like the National Council of such Real Estate Investment Fiduciaries Index, subdivided by the property sector, is one way to use property derivatives. Investors may acquire a stake in a new property sector, even if they don't currently own any properties in that sector.

If investors want to diversify their portfolios, they may do so by investing in a variety of different industries and then swapping the profits from each one. For a period of time, generally up to three years, investors may use swaps to adjust or rebalance their portfolios strategically. Some other ways to replicate exposure include going long or going short, i.e., purchasing and selling properties in the same way.

How Are Property Derivatives Traded?

Trading in property derivatives may be too much for some individuals to handle. The procedure, on the other hand, resembles stock market trading. You'll be able to see all of the benefits if you take the time to look into the specifics. Investing in property derivatives might be challenging, but the following suggestions can help:

- Ensure that you've done your homework: By thoroughly assessing any property, one may get the benefits of an asset while avoiding any potential dangers.

- Calculate the margin: The margin fluctuates in response to changes in the asset prices. In order to be prepared for any unexpected events, you should save some additional money in your bank account.

- Assets/contracts may be selected: Make a list of the assets or contracts that you want to acquire. Find out how much money you need to put into it and make sure it's a good match for your financial situation.

- The contract must be signed, and the transaction or agreement must be finalized before you may do business.

- To settle the contract, you may do one of two things: wait until it has expired, at which point you can settle it, or make an opposite transaction.

If you're still having trouble getting started or if you're having a hard time understanding the whole procedure, you may always employ a professional.

Conclusion

Derivative financial instruments vary in value based on changes in the value of said underlying property asset. Investing in the real estate market may be risky; therefore, investors utilize property derivatives to hedge their bets.