Knowing what is rule of 72 and what to invest in and where to put it can be daunting. It's so daunting that many do not get to the next step of working out how to forecast the growth of their investments, even though it's vital to create budgets and look for goals.

Rule of 72

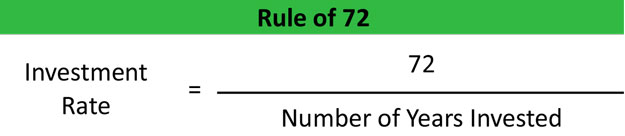

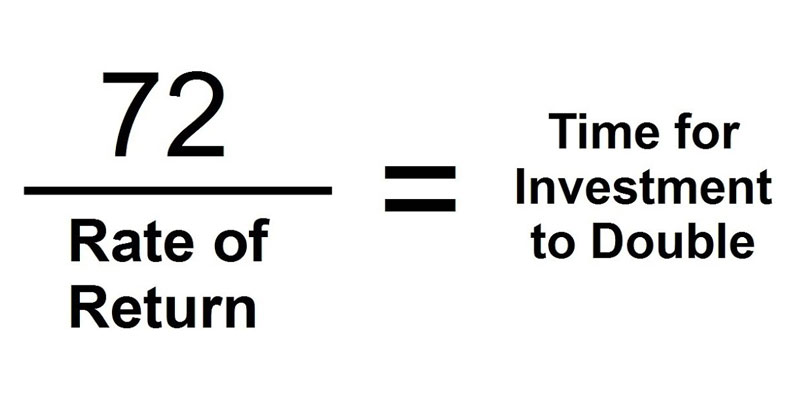

It is believed that the rule of 72 is an easy method to estimate the amount of time investment will take to double at a given fixed annual interest rate. When you divide 72 times the rate per year, investment managers will estimate how long it will take for their initial investment to replicate itself.

The rule of 72 is a simple, effective formula commonly utilized to calculate the length of time needed to double the amount invested at a specific annual return rate. It can also calculate the annual compounded returns from investments when it's time to double your investment.

In finance, there are three rules; the rule of 72, the rule of 70, and the rule of 69.3. These are ways to estimate the time it takes to double an investment. The number in the rule is divided by the percentage of interest per time unit to determine the approximate amount of time needed to double. While spreadsheets and scientific calculator applications have functions that can determine the exact doubling time, these rules can be useful for calculating mental calculations when a simple calculator is accessible.

The Rule of 72 Origins

Since early times, interest has been present in economic and mathematical studies. It is believed to be as old as Greek and Roman culture. The Qur'an even speaks of the concept. Its origins are in agriculture and the first forms of loans to the land and for money. The first person to use that rule of 72 was Luca Pacioli, an Italian mathematician. Some believe Albert Einstein was the inventor of this rule. There is no evidence to back this up, however.

How to Calculate?

To determine the rule of 72, all you need to do is divide 72 by the return rate. The calculation below is for the time it takes to double in terms of days, months, or years, based on the way in which you want the rate of return stated. For instance, if you enter the yearly interest rate, you'll be able to calculate the length of time it will take your investment to double.

How to Modify for Higher Accuracy?

It is believed that the rule of 72 is relatively more precise if it is modified to match the compound interest rate closely. This effectively converts this rule of 72 to the rule of 69.3. A lot of investors prefer using the rule of 69.3 instead of that of 72. For higher accuracy, especially for continuous compound interest formula tools, utilize the rule of 69.3. No. 72 contains a variety of functional factors, including two, three, four, six, and nine. This makes it simpler to apply this rule of 72 for an approximate representation of compounding times.

How to Plan for Investment?

If your interest rate fluctuates or you require more cash due to inflation or any other reason, you can use the data from the rule of 72 to aid you in determining how to continue investing over the course of time. It is also possible to use the rule of 72 to make decisions regarding risk versus reward. Many young people are just beginning to make investments that are high risk due to the possibility of benefiting from high returns for multiple double-cycles. People nearing retirement are likely to choose to invest in accounts with lower risk when they are nearing their desired amount to retire since the doubling cycle is not as important as investing in safer investment options.

Conclusion

It is believed that the rule of 72 lets you determine a general estimate of the amount of time it will take to yield twice your funds with a fixed yearly interest rate. When you've got an average return and have a current amount of money, it is possible to estimate the amount of time it will require to double. This is a very useful instrument for retirement planning as well as long-term financial planning. While you may also wish to employ a more thorough projection method in the future, using the rule of 72 can provide a fantastic starting place.