When seeking to invest in government bonds, investors often choose between two primary categories: Treasury bonds and municipal bonds. Both of these categories fall under the umbrella term "government bonds." Investors who want to either build up the low-risk section of their portfolio or save money at higher, low-risk rates can do either. Along with money market accounts, certificates of deposit, and high-yield savings accounts, Treasuries and municipal bonds are often considered the best low-risk bond choices.

An Introductory Discussion on Government Bonds

To begin, let us get familiar with certain common terminology that is important to keep in mind while looking at government bonds:

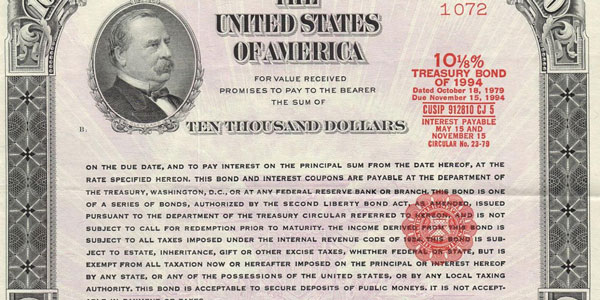

- A Treasury bond is a security that the government of the United States issues.

- A municipal bond is a kind of financial security issued by a local or state municipality.

- Maturity may be thought of as the life of the relationship.

- The amount of money received as a return on an investment in a debt instrument is referred to as the yield. There are several distinct varieties of bond yields and numerous approaches to determining each.

- A coupon denotes the amount of interest paid at regular intervals.

- A bond rating is a rating assigned to a bond by a rating agency based on the traits and features of creditworthiness.

- Government bonds are the governments' debt obligations in their most basic form. The federal government is the entity that issues federal bonds, also known as sovereign bonds, and the federal government's credit rating serves as the backing for all of these bonds.

The proceeds from the sale of municipal bonds and federal Treasury bonds are used in the same way: they finance initiatives or operations carried out by the respective governments. These government bonds come with several exceptional tax benefits, which distinguish them from other bands on the bond market in general. Because the location at which you may buy a certain sort of government bond is dependent on the type of government bond that you are searching for. You must first pick which form of bond you want to acquire.

Investing in Government Bonds

The notice of upcoming auctions is the first phase in the auction process. This announcement is typically made between four and five working days before the actual auction. In this phase, information on the number of bonds sold by the Treasury, the auction date, the maturity date, the terms and conditions, eligible participants, and the competitive and non-competitive bidding closure times are disclosed. The Treasury Department strives to make TreasuryDirect as user-friendly as possible. All that is required of you is to:

- To access the TreasuryDirect website, visit website.

- Create a new user profile.

- You should begin investing depending on the maturity and yield characteristics you want. The bare minimum to invest is one hundred dollars. You can invest in Treasury bonds over the full yield curve range with only one hundred dollars.

- In addition, investors now have the option of purchasing Treasury bonds by using a brokerage account.

Funds That Are Managed

When it comes to Treasury investments, many individuals may choose to work with professional money managers. The United States Treasury is one of the asset classes that may be bought and sold via various mutual funds and exchange-traded funds (ETFs). A wide selection of exchange-traded funds (ETFs) is available for investing in government bonds, such as TIPS, short-term, and long-term treasuries. Most of these exchange-traded funds have reasonable annual fees, with most charging less than 0.20 percent annually.

Money Markets

You may also purchase Treasury bills by investing in a money market mutual fund that the Treasury manages. After investing in one of these funds, purchasing and selling Treasury notes is a simple process. There are several severe restrictions. It is highly recommended that you create an account with the brokerage firm that provides the Treasury money market mutual fund you are interested in purchasing. There is often a large minimum investment requirement associated with purchasing Treasury money market funds and hefty fees.

Investing in Local and State Government Bonds

The second sort of government bond available to investors is a municipal bond. The state governments or local municipalities issue them in these regions to support infrastructure and other government operations.

Evaluations of Municipal Bonds

Another factor considered while analyzing municipal bonds is their maturity, which may range anywhere from one month to thirty years. The municipal bond yield curve for the AAA municipal market as of December 2020 is shown in the following graphic.

Funds That Are Managed

As a result of the higher level of complexity inherent in municipal bonds compared to Treasury bonds, many investors choose to place their money in managed funds rather than handle their municipal bond investments.

Tax Advantages

The interest obtained from federal bonds is normally free from state and municipal taxes, but it is still subject to taxation at the federal level. In addition, investors who purchase municipal bonds issued inside their state are exempt from paying income taxes on such investments. Other options are available on the municipal bond market for investors responsible for the alternative minimum tax.