In the budgeting method known as zero-based budgeting, your income is subtracted from your spending until the difference is equal to zero. It inspires you to put the money that comes in each month toward your costs, the reduction of your debt, and other financial objectives. You will have complete transparency on your money movement every month if you use this technique.

Take your monthly take-home pay as an example: let's suppose it's $3,000. With a budget based on zero, you would put all that money toward paying bills, putting money away, and spending such that you would have no money left over at the end of the month.

How a Zero-Based Budget Works

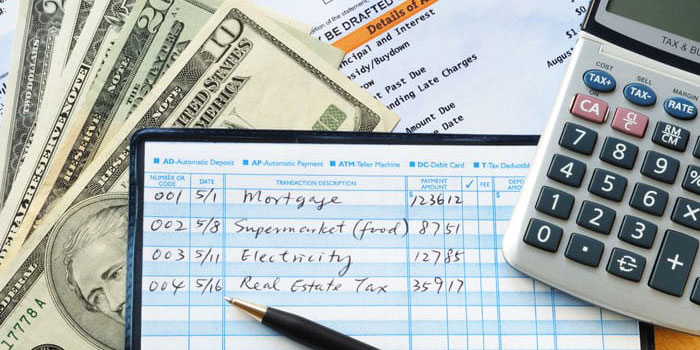

You first need to calculate how much your monthly salary makes into your pocket. Next, you will need to have a complete accounting of all of your monthly costs. The next step is to devote all your dollars and cents to pay off those debts. This includes any money you want to put away for future use, as well as any money you intend to use for activities such as shopping or eating at a restaurant.

For illustration's sake, let's pretend that your monthly take-home pay from work is $5,000. You might spend $2,000 of it toward your monthly living costs, such as rent, utilities, and food, and the other $1,000 may go toward paying off your credit card debt and school loans.

After that, you put $1,500 into savings so that you may build up your emergency fund and purchase a home at some point in the future. The remaining five hundred dollars may be used for anything within your financial means, such as going out to eat, shopping, traveling, or filling up your petrol tank. Your total revenue of $5,000 minus all your costs, also totaling $5,000, comes to a total of $0. This is the situation.

If you have a budget based on zero, then any money left over after spending less than you planned in one area should be moved to another. On the other hand, if you go over budget in one area, you will need to find more funds in another department to make the difference.

Pros

Provides access to visibility

When you use a budget starting at zero, it is incredibly simple to track precisely where your money goes each month. If you put this plan into action, you will be able to see very clearly that you spent X on costs, X on debt, X on savings, and X on the things you wanted.

Prevents overspending

A budget that starts at zero might be helpful if you have the propensity to overspend. Because the money has already been spent on another component of your budget, you may be less inclined to spend money you do not have.

Prioritizes financial objectives

You may tailor a budget from scratch, starting from zero, to fit your specific financial objectives. For instance, if you want to pay off your student loans as quickly as possible, you may designate a sizeable portion of your monthly income to pay off that debt.

Cons

Taking a lot of time to produce

Creating a budget with no surplus or deficit may be time-consuming. You will need to figure out how much your monthly salary you will get, select how you want to spend that money, and assign each dollar to a specific category.

Possibly challenging because of the unpredictability of the revenue

If you are self-employed, a freelancer, or a single proprietor, or if you work on commission, the amount of money you bring in each month may change. Given the unpredictability of your income, it may not be easy to develop and adhere to a budget based on zero, especially if you do not have any savings. If you're fortunate, you may be able to calculate how much money you have available to spend this month based on how much money you made the month before.

How to Make Your Very Own Budget Starting from Zero

Determine Your Net Income

Include the amount of your paycheck in the total monthly income you get. This will inform you of the amount you have available to spend each month.

Keep an eye on your spending

Keep track of your typical expenditures with the help of your credit card bills and receipts over a few months. If you follow these steps, you will find parts of your budget in which you may reduce your spending, as well as places in which you would want to dedicate more money.

Categorize Your Expenses

Put both your costs and your priorities down on paper. Include everything you need as well as everything you want. Others, like your rent, utilities, and health insurance, can fall into the category of necessities, while things like your gym membership, takeaway meals, and entertainment might fall into the category of desires. Create a category in your savings account called "housing fund" if you want to save money to purchase a home.